Sources and methodology

MedIns utilises a particular kind of sources from which it extracts data: the Ottoman fiscal registers known as mufassil defters. These are detailed surveys that present a snapshot of a province's rural economy, tailored for the purposes of taxation. This may not necessarily reflect the most accurate depiction of an economic space, but the same can be said of any kind of data recorded for taxation purposes. After all, do contemporary taxation figures reflect the actual functioning of an economy? Be that as it may, these registers constitute one of the best and most detailed sources at the disposal of historians of the Ottoman Empire and, at the very least, allow safer conclusions for understanding the bigger picture of economic trends.

The registers examined by MedIns provide detailed information on the monetary value and volume of taxable goods and products related to the largely agricultural economy of the two islands in the sixteenth and seventeenth century. The value of the goods is then multiplied by five (the tithe was 20%), by which we have the total of the assessed value and volume of the relevant product. Different categories of products include cereals (wheat, barley, oats, vetch), legumes (lentils, black-eyed peas, chickpeas, broad beans), different kinds of tree and plant crops (olives, walnuts, almonds, sesame, carobs, grapes), or textiles and other manufacturing goods (cotton, flax, silk, leather). There is also information on gardens and orchards, water- and wind-mills, animal herding, taverns, fines and dues, and other monetary taxes such as the poll tax.

Another aspect of these registers concerns information on demographics. The data, however, is partial and cannot provide definitive conclusions. This is because Ottoman fiscal registers only provide information relevant to taxations, and as a result only record heads of households or other taxable (or tax-exempt) individuals. The number of other members of a household could be anyone's guess, and despite many attempts to employ a multiplier, there is no definitive answer. Once more, such figures are more useful if employed to study trends.

Finally, and more importantly for the purposes of georeferencing and the utilisation of GIS methods, Ottoman fiscal registers are invaluable sources for toponyms and geographic information. Historical toponymy remains a fragmented field, and the different sovereignties that Cyprus and Crete have underwent have left the study of place names with many gaps due to the multiple linguistic and historical skills necessary. Such comprehensive toponymic sources offer valuable answers towards a detailed understanding of the evolution of place names. Most importantly, and usually when a historical toponym is identified with a contemporary one, it is the possible to georeference a place in order to analyse and combine other attributes such as elevation, height, soil, access to water resources, etc. This data is then correlated and statistically analysed with the economic production data from the Ottoman fiscal registers.

An example from the village of Sotira in the Mesaoria/Mesarya district.

| Category according to T.T. 64 register | Information |

|---|---|

| Province/Nahiye | Mesarya |

| Settlement type | Village/Karye |

| Settlement name | Sotira |

| Existing | Y |

| Venetian name | Sotira |

| Francomati in 1565 | 77 |

| Non-Mulsim male taxpayers/Neferan | 67 |

| Households/Hane | 57 |

| Bachelors/Mücerred | 10 |

| Widows/Bive | 3 |

| Blinds/A'ma | 1 |

| İspence tax/İspence | 2010 |

| Widow tax/Bive resmi | 18 |

| Wheat, keyl/Hınta, keyl | 75 |

| Wheat, akçe/Hınta, akçe | 900 |

| Barley, keyl/Şair, keyl | 225 |

| Barley, akçe/Şair, akçe | 1350 |

| Vetch, keyl/Burçak, keyl | 15 |

| Vetch, akçe/Burçak, akçe | 90 |

| Lentils, keyl/Mercimek, keyl | 2 |

| Lentils, akçe/Mercimek, akçe | 26 |

| Broad beans, keyl/Bakla, keyl | 2.5 |

| Broad beans, akçe/Bakla, akçe | 25 |

| Bee-hives, akçe/Resm-i gevare, akçe | 50 |

| Sheep tax/Adet-i agnam, akçe | 1000 |

| Pigs tax/Bidaat-ı hanazır, akçe | 85 |

| Fruit orchards tax/Resm-i meyve, akçe | 180 |

| Tavern Tax/Mahsul-ı meyhane fi-sene, akçe | 300 |

| Stray animals duty/Adet-i deştbani, akçe | 43 |

| State taxes/Mahsul-ı beytülmal etc, akçe | 67 |

| Various charges/Bad-ı hava […etc.], akçe | 75 |

| Total, akçe/Yekün, akçe | 6219 |

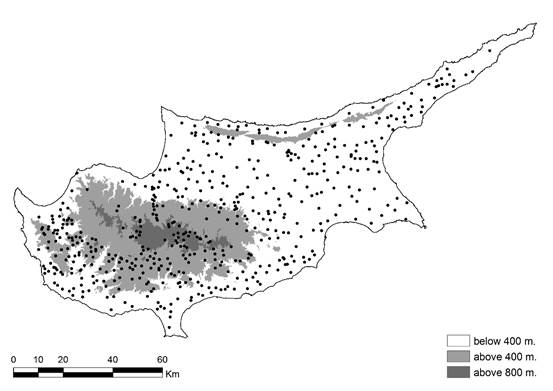

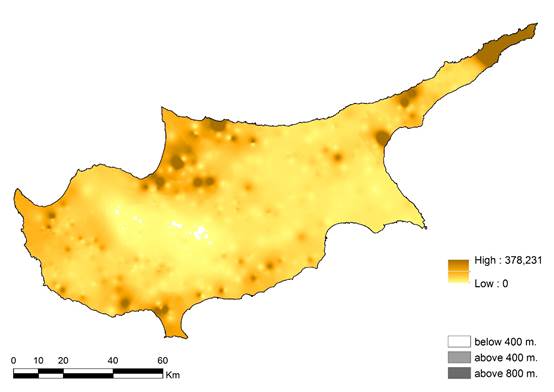

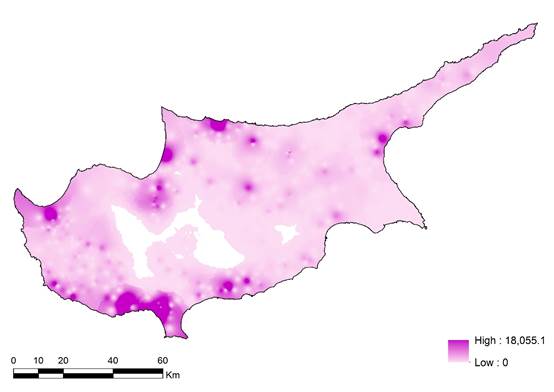

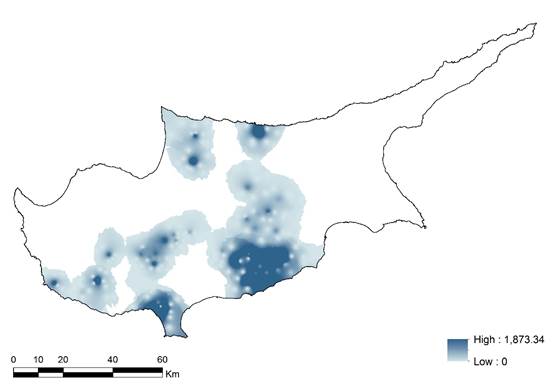

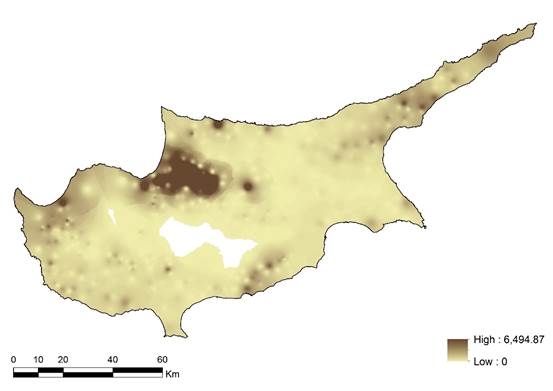

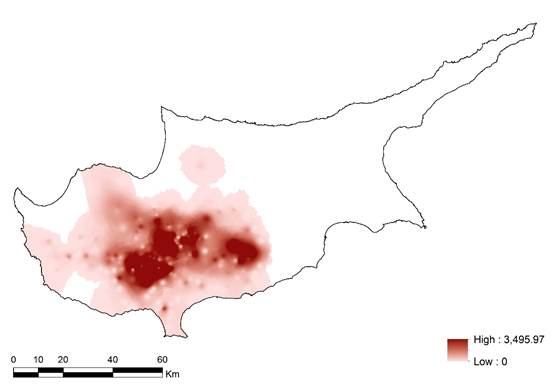

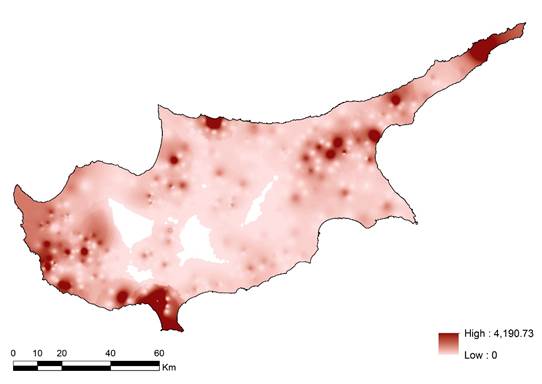

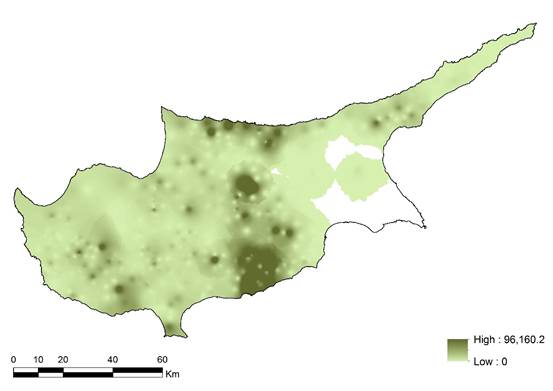

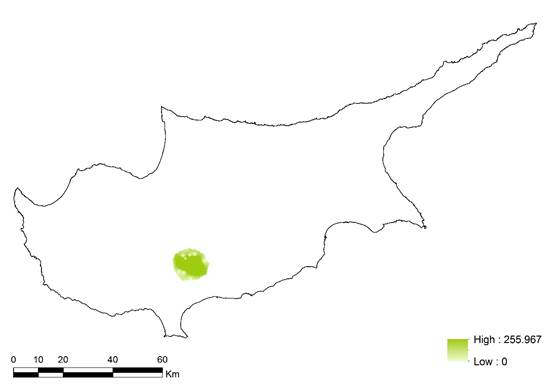

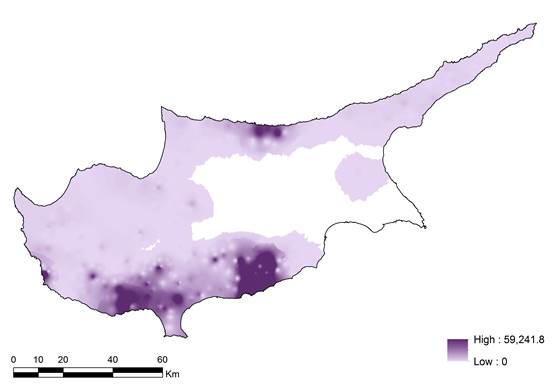

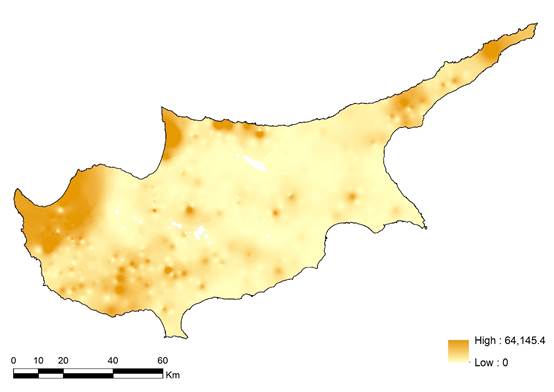

Visualising economic space

One method of spatial analysis of the fiscal register data is Inverse Distance Weighted (IDW) Interpolation. Through this visualisation we can detect certain trends and patterns in the distribution of particular commodities according to the 1572 Cyprus fiscal survey. The following maps constitute a sample of the commodities found in the register.

Geodata provided by the Department of Geological Survey of Cyprus

Geodata provided by the Department of Geological Survey of Cyprus

Historical maps as sources

MedIns also employs historical maps as sources of data. It does so by digitising the first modern maps of Cyprus compiled by the British upon their arrival to the island in the latter decades of the nineteenth century. More specifically, the project uses the plans of the cities of Nicosia and Famagusta on a scale of 1:2,500 (undated, c. 1881), and a map of the whole island (entitled A Trigonometrical Survey of the Island of Cyprus) on a scale of 1:63,360 (conducted in 1882; published 1885). These maps were compiled by Horacio Kitchener, who employed the latest technology of the time and offers a mine of information for the student of landscape, particularly so from the perspective of economic history. For example, the plan of Nicosia depicts gardens, orchards and green space, wells, chains of wells (lagoumia), conduits, or water tanks. Their issues of accuracy notwithstanding, these maps remain extremely useful in the range of information they provide, and offer the best available source recording the Cypriot landscape that has a tolerable temporal remoteness. That is to say that from a macroscopic point of view, the expected changes within a timespan 300 years do not justify discarding this source.